Share:

Image

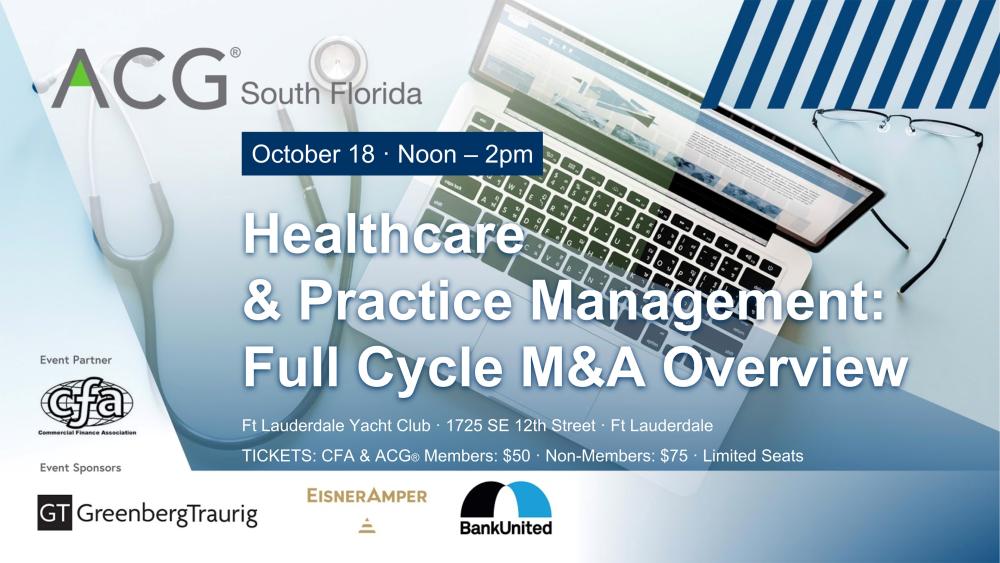

Event Details

When:

October 18, 2018 12 PM - 2 PM EDT

Where:

Location Name

Lauderdale Yacht Club

Speakers

Event Secondary Body

Join ACG South Florida and CFA for this timely panel discussion. Please register in advance in order to attend! Web registration will be closed at 5 pm on October 17th!

Tickets: $50 for ACG and CFA Members; $75 for Non-Members

| 12:00-12:30 pm | Registration and Networking | |

| 12:30-2:00 pm | Lunch and Panel Presentation | |

Hosted by: ACG

Chapter

South Florida