Session Details

As investment pours into artificial intelligence at unprecedented levels, questions around valuation, sustainability, and long-term impact are growing louder. This panel explores the possibility of an AI market correction, not as a crisis, but as a natural and healthy evolution of an emerging technology cycle.

Industry leaders, investors, and operators will discuss how an AI “reset” could separate signal from noise, strengthen the most viable business models, and create new opportunities for disciplined innovation and M&A. From lessons learned in past tech cycles to practical guidance on navigating the next phase of AI adoption, this session offers a grounded, optimistic perspective on what comes after the hype.

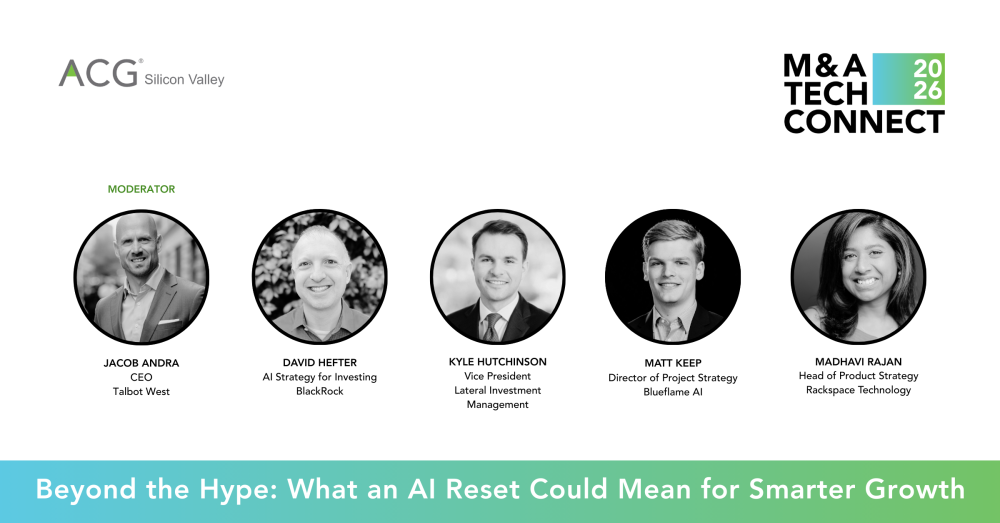

Speaker Bios

David Hefter, AI Strategy for Investing at BlackRock

David Hefter leads BlackRock’s internal AI strategy, adoption, and governance across public and private markets investing. His background includes studying AI as an undergraduate at Columbia and driving BlackRock’s growth for over 20 years, including building NLP solutions for investing since before Generative AI. David helps advance firmwide AI adoption through engagement, training, and community, including producing a weekly internal AI newsletter.

Kyle Hutchinson, Vice President at Lateral Investment Management

Kyle Hutchinson is a Vice President at Lateral Investment Management. Kyle leads Lateral’s deal origination activities for new platform investments and add-on acquisitions for existing portfolio companies. Before Lateral, Kyle was a senior associate at K1 Investment Management, a private equity firm with over $13 billion in assets under management. At K1, Kyle was responsible for identifying and evaluating buyouts and growth investments in enterprise software companies. Prior to K1, Kyle worked as an Assistant Vice President at Franklin Templeton Investments and began his career at J.P. Morgan Securities.

Kyle holds a degree in Business Administration from the Marshall School of Business at the University of Southern California, where he graduated Cum Laude.

Matt Keep, Director of Project Strategy at Blueflame AI

A seasoned technology investor, Keep joins Blueflame from Recognize Partners, a private equity firm focused on investing in digital services businesses. At Recognize, Keep helped deploy the firm’s inaugural fund and played a pivotal role in evaluating investment opportunities across thematic focus areas. Additionally, he co-led efforts to adopt AI internally and realize its potential to accelerate diligence processes and drive value creation across the portfolio. Prior to Recognize, Keep was an investor at Audax Group, a middle-market private equity firm, where he invested in healthcare and technology companies. He graduated cum laude from Duke University with a B.S. in Economics and a minor in Computer Science.

Madhavi Rajan, Head of Product Strategy at Rackspace Technology

Madhavi is a strategic product and infrastructure executive with more than 20 years of experience turning complexity into scalable growth across AI, cloud, and data center markets.

She has led multi-billion-dollar product portfolios, scaled global organizations of 800+ professionals, and driven enterprise AI strategy, infrastructure transformation, and growth through M&A and go-to-market shifts. Her strength lies in connecting long-term vision with operating rigor, translating bold strategic bets into measurable business outcomes.

Madhavi’s experience spans the full technology stack, from semiconductors and cloud platforms to AI-native products, bringing a systems-thinking mindset to complex, high-growth environments. She is trusted to lead through inflection points including post-M&A integration, new AI business launches, and executive alignment, delivering clarity, momentum, and results.

She is currently focused on senior leadership roles where she can shape strategy, scale high-performing teams, and unlock enterprise value with speed and purpose.

Jacob Andra, CEO at Talbot West (moderator)

Jacob Andra is the CEO of Talbot West, an AI enablement firm that helps private equity portfolio companies and acquisition targets transform AI capabilities into measurable value creation. He advises dealmakers on AI maturity assessment during due diligence and architects post-acquisition technology roadmaps that drive margin improvement and operational scale.

Jacob founded Talbot West on a thesis now gaining traction among sophisticated investors: the enterprise AI landscape has over-indexed on large language models, leaving significant value on the table. Portfolio companies that compose multiple AI technologies into ensemble architectures capture compound advantages competitors cannot replicate with off-the-shelf tools. His firm helps investors and operators evaluate technology-use case fit and distinguish defensible competitive moats from commodity capabilities.

Talbot West's assessment methodology spans the full AI spectrum: predictive analytics for forecasting and valuation models, computer vision for quality control and asset monitoring, optimization algorithms for supply chain and resource allocation, and neurosymbolic AI for regulated decision-making. Jacob hosts The Applied AI Podcast and speaks at ACG events and other M&A-focused forums on translating AI capability into enterprise value.