Session Details

Successful M&A today depends on far more than valuation and deal structure—it hinges on the strength of the underlying technology. This panel will explore how core systems and digital infrastructure drive transaction readiness, integration success, and long-term value creation. Panelists will discuss the critical role of cybersecurity, enterprise platforms, and data integrity in due diligence and post-close integration, as well as how technology investments support scalable growth and measurable ROI. Attendees will gain practical insights into how modern tech foundations can accelerate value realization and reduce risk throughout the M&A lifecycle.

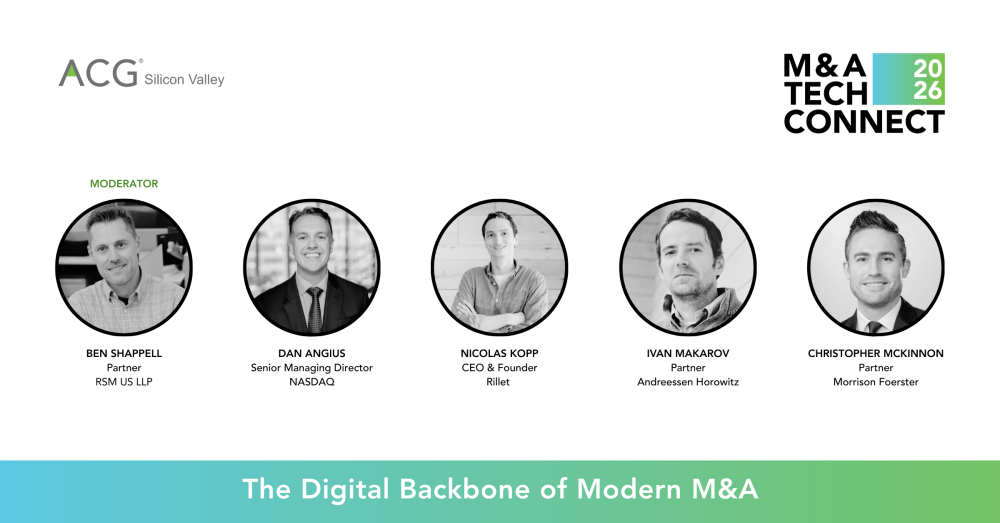

Speaker Bios

Dan Angius, Senior Managing Director at NASDAQ

Dan Angius is a Senior Managing Director of New Listings and Capital Markets at Nasdaq, overseeing the division’s relationships with private companies in California. Dan serves as a resource on topics such as corporate governance, investor relations, and capital markets with the goal of creating a smooth transition to the Nasdaq exchange and public markets overall. Prior to Nasdaq, Dan spent five years at Goldman, Sachs & Co. in the Investment Management Division, managing portfolios of various family offices and foundations. He earned a Bachelor of Science from the University of Southern California and a Master of Business Administration from Vanderbilt University’s Owen Graduate School of Management.

Ivan Makarov, Partner at Andreessen Horowitz

Ivan Makarov is a portfolio finance partner on the early stage venture operating team at Andreessen Horowitz, where he supports our portfolio companies on all things finance. Prior to joining a16z, Ivan spent 12 years scaling finance and operational teams,

processes and systems as an executive leader at Flickr, SmugMug, and most recently Webflow (2020-2024), when the company grew from 100 to 650+ employees, while also leading over $250 million of Series B and C equity investments into Webflow.

Ivan received his Master and Bachelor of Accounting degrees from Brigham Young University and earned his Certified Public Accountant (CPA) license during his first five years with PwC and EY.

Ivan lives near San Francisco with his wife, four kids, two cats and a golden doodle. He is also an obsessive photographer, and loves to ski and mountain bike.

Christopher McKinnon, Partner at Morrison Foerster

Chris represents venture capital investors, private equity firms, and emerging and established companies in corporate finance and securities matters, including venture capital, growth equity and private equity investments, mergers and acquisitions, joint ventures, restructurings, and other strategic transactions.

Chris has significant experience advising on complex deals involving high-growth, venture-backed companies in the technology industry (AI, Fintech, AR/VR, semiconductors, software). For private equity sponsors, he advises on investment fund transactions, buyouts, and divestitures. For entrepreneurs, he advises fast-growing emerging companies throughout their lifecycle, from formation through exit.

Nicolas Kopp, CEO & Founder at Rillet

Nicolas Kopp is the founder and CEO of Rillet, the AI-native ERP for hyper-growth companies and public enterprises. Rillet has raised >$100m from Sequoia, a16z, and Iconiq. Based in San Francisco, Nic was formerly the US CEO of fintech bank N26 (valued at $9bn). Prior to N26, Nic spent five years in investment banking at Morgan Stanley. He holds a BA from University of St. Gallen in Switzerland and an MSc in Accounting from the London School of Economics.

Ben Shappell, Partner at RSM US LLP (moderator)

Ben has more than 20 years of accounting and audit experience and is RSM's TMT Audit Industry Leader. He provides diverse accounting and advisory services, primarily in the technology, life sciences and manufacturing and distribution industries. Ben works with companies throughout their lifecycle, from dynamic emerging growth companies raising their initial capital, to high growth companies expanding globally, to companies contemplating a liquidity event through either the public markets or a merger. He has significant experience with complex revenue recognition and debt and equity accounting, as well as extensive experience in SEC accounting and reporting matters, including Sarbanes-Oxley compliance.

Ben spent more than 10 years working in RSM’s Boston office and repatriated to San Francisco in 2018 after working for two years in London as a part of RSM’s expatriate program, where he supported the firm’s internationally active clients as a member of the global engagement team by coordinating and executing on U.S. standards for audit engagements.