ACG Atlanta is excited to present quality Keynote speakers and thought leaders on our panels.

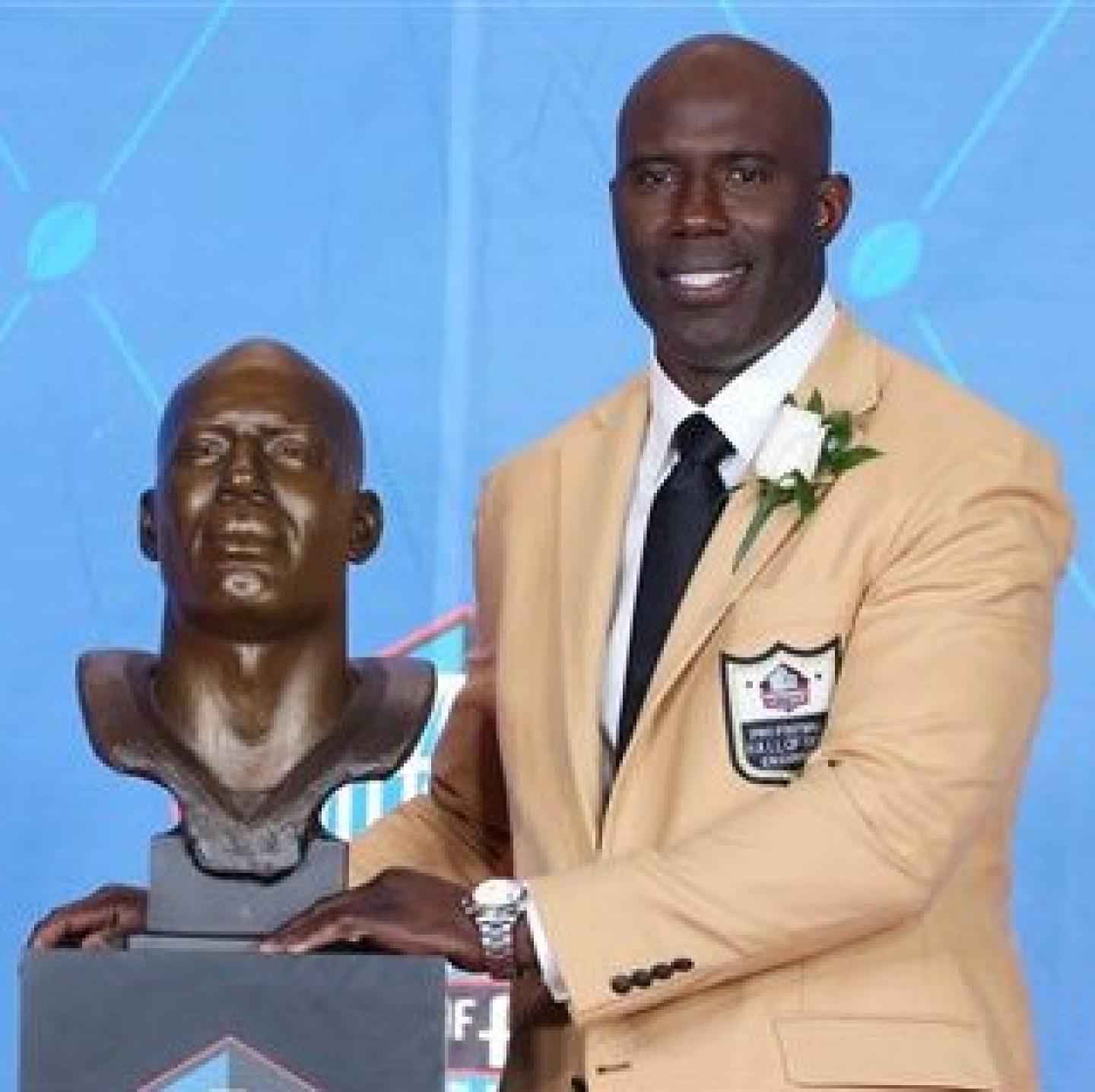

Keynote Speaker

Blockchain Panel

Cybersecurity Panel

Debt Market Update Panel

Fintech Roundtable

Healthcare/Physician Services Roundtable

M&A Trends Panel

Opening Session - Corporate Development Panel

Event Details

When:

February 5 - 7, 2019

Where:

The Hotel at Avalon, Autograph Collection