Event Details

When:

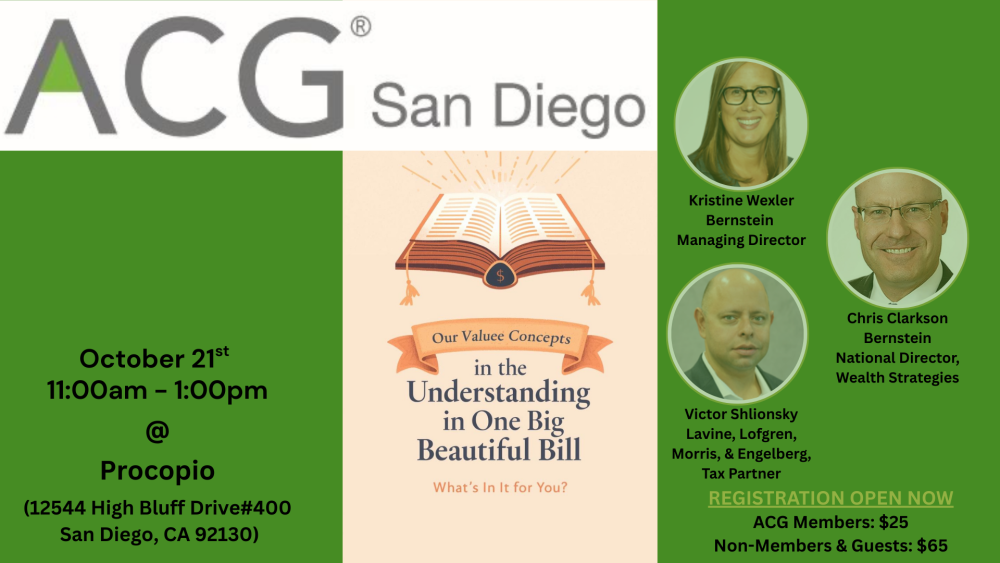

October 21, 2025 11 AM - 1 PM PDT

Where:

Add to Calendar

Overview

This lunch-hour briefing will provide a discussion of the "One Big Beautiful Bill," a landmark piece of legislation with significant implications for your company's bottom line. Our subject matter experts will explain the critical tax and regulatory changes affecting individuals and businesses of all sizes. We'll explore how these new provisions, which include making key tax deductions permanent and offering new incentives for investment, could create opportunities for growth. This is an essential session for high wage earners, business owners, CFOs, and their advisors who need to understand how to adapt their financial strategies and leverage the new law to their advantage.

Key Takeaways for Attendees

- Gain a clear understanding of the permanent extensions offered in this bill and how they impact individuals and businesses.

- Learn about the reintroduction of 100% bonus depreciation and changes to research and experimental (R&E) cost expensing and the implications to tax incentives like QSBS.

- Explore the impact to charitable deductions as it relates to income limits and floors. This will be especially relevant to business owners considering a sale in the future.

- Explore the federal SALT deduction cap and California’s Pass-Through Entity (PTE) tax election, outlining how it works, who qualifies, and strategies to maximize potential tax savings.

Moderator:

Kristine Wexler, Bernstein, Managing Director

Panelists:

Kristine Wexler, Bernstein, Managing Director

Kristine Wexler is a Principal and Managing Director responsible for Bernstein’s private client practice in the San Diego area. She is focused not only on growing the office and our impact in San Diego but also working directly with clients. Prior to assuming this current role in January 2024, she was a Vice President and Wealth Advisor in Bernstein’s Chicago office. In that role, Kristine was responsible for guiding individuals and families in making investment and planning decisions that will help them achieve their goals. Prior to joining Bernstein in 2020, she advised high-net-worth families at Bessemer Trust for 19 years, as client advisor and senior client advisor. Kristine holds a BS, cum laude, in biology and philosophy from Syracuse University and an MBA, cum laude, with a concentration in Economics, Finance and Entrepreneurship from the University of Chicago, Booth School of Business. Additionally, Kristine is a CERTIFIED FINANCIAL PLANNERTM professional. She is an executive board member of Burling Bank, a Chicago based privately owned bank. She is also a board member of The San Diego Humane Society and The Community Resource Center.

Chris Clarkson, Bernstein, National Director, Wealth Strategies

Mr. Clarkson is a Senior Vice President and a National Director in Bernstein’s Wealth Strategies Group. He has expertise in a variety of complex investment planning issues, including selling a business, charitable giving, multigenerational wealth transfer, and diversification of concentrated stock and option portfolios. Mr. Clarkson is a frequent lecturer to groups of tax and legal professionals throughout the western United States. He has given educational seminars for the USC Tax Institute, Hawaii Tax Institute, Colorado Society of CPAs, Estate Planning Council of San Diego, Beverly Hills Bar Association, and University of San Diego Nonprofit Leadership and Governance Symposium. Mr. Clarkson joined the firm in 1995 and has been a member of the Wealth Strategies Group since 1998. He earned a BA with high honors in business/economics from the University of California, Santa Barbara, and is a Chartered Financial Analyst charter holder.

Victor Shlionsky, Lavine, Lofgren, Morris, & Engelberg, LLP, Tax Partner

Victor Shlionsky is a tax partner at Lavine, Lofgren, Morris, & Engelberg, LLP. Victor provides high net-worth individuals and closely held businesses with strategic estate & income tax guidance. Victor chair’s the California Society of CPA estate committee. In addition, Victor is an avid lecturer on complex tax & estate topics and was recently honored as San Diego’s 40 Under 40 leader in SD Metro magazine. Victor earned bachelor degrees in accounting, and business administration from Loyola Marymount University and a masters degree in taxation from California State University, Northridge.

REGISTRATION OPEN NOW

- ACG Members: $25

- Non-Members & Guests: $65

AGENDA

- 11:00 am – 11:30 am: Networking

- 11:30 am – Noon: Lunch

- Noon-12:45 pm – Presentation

- 12:45-1:00 pm – Q&A

- 1:00 pm – Conclusion

Questions?

Contact acgsandiego@acg.org.

Please Note: Your registration for this event acts as an audio/video release and includes your permission for ACG San Diego to use your image and comments captured on audio, video, or photographic formats while attending the event for marketing and promotional purposes. For further information, please contact: acgcsandiego@acg.org.