ACG St. Louis Member News

We encourage ACG St. Louis members to submit their deal news to us to share via social platforms and on our website! Share your news including closed deals, new hires in your corporate growth/M&A group, promotions, awards and accolades.

Submit news online here or via e-mail to ACG Communications Committee Chair, Robyn Frankel, Frankel Marketing/PR at rfrankel@frankelpr.com.

Questions? Contact Amy Ruebsam at aruebsam@acg.org

---------------------------------------------------------------------------------------------------------------------------

Bridgepoint Advises RB Global and IAA on Sale of DDI Technology to Vitu, a Portfolio Company of Accel-KKR:

Bridgepoint Investment Banking served as the exclusive financial advisor to RB Global and IAA on the strategic sale of its subsidiary, DDI Technology, to Vitu, a portfolio company of Accel-KKR. DDI Technology specializes in providing secure, cloud-based electronic vehicle title and registration services for lenders, dealers, and state agencies within the IAA marketplace. This acquisition is a strategic move for Vitu, as it significantly expands their lender and dealer network, enhancing their comprehensive, end-to-end title and registration solutions and accelerating their growth as a market leader in vehicle-to-government solutions. The sale allows RB Global to successfully divest a non-core asset and sharpen its focus on its primary marketplace strategy. To read more, click here: https://www.bridgepointib.com/experience-info/rb-global

Bridgepoint Advises Bingham & Taylor on Its Sale to Charlotte Pipe and Foundry:

Bridgepoint Investment Banking acted as the exclusive financial advisor to Virginia Industries on the sale of its 175-year-old subsidiary, Bingham & Taylor, to Charlotte Pipe and Foundry in conjunction with Neenah Foundry Company. Bingham & Taylor, renowned for its 100% American-made meter and valve access products for water and gas utilities, was highly attractive to Charlotte Pipe due to its strong brand reputation, established distribution network, and domestic manufacturing footprint. The transaction was executed rapidly—moving from indication of interest to close in just 45 days—resulting in a smooth transition and a strategic combination expected to leverage Bingham & Taylor's commercial strength with Charlotte Pipe's manufacturing expertise. To read more, click here: https://www.bridgepointib.com/experience-info/binghamtaylor

---------------------------------------------------------------------------------------------------------------------------

Thompson Street Capital Partners has successfully sold Freddy's Frozen Custard & Steakburgers:

Thompson Street Capital Partners (TSCP), a St. Louis-based private equity firm, has successfully sold Freddy's Frozen Custard & Steakburgers to Rhône, a global private equity firm. "Under TSCP's ownership for the past five years, Freddy's focused on foundational improvements and growth investments, which led to significant operational milestones. The partnership was centered on enhancing the guest and franchisee experience through improvements in back-of-house efficiency, digital platforms, menu innovation, and franchisee support." To read more, click here: https://www.tscp.com/news/freddys-acquired-by-rhone-from-thompson-street-capital-partners-to-drive-continued-market-expansion/.

---------------------------------------------------------------------------------------------------------------------------

ACG ST. LOUIS ANNOUNCES 2025 CHAPTER ADVISORY BOARD

January 9, 2025, St. Louis – The St. Louis chapter of the Association for Corporate Growth (ACG), a global membership association for professionals involved in corporate growth, corporate development, and mergers and acquisitions, announced two new appointments to its Chapter Advisory Board and recognized three retiring board members for their outstanding service and leadership.

The new directors include Aaron Randolph, Senior Vice President and Commercial Team Lead at UMB Bank and David Bentzinger, Managing Director at PNC Bank. Retiring directors include Rose Thompson, Chief Operating Officer of ButcherJoseph & Co., Peggy Northcott, Managing Member at Capital Performance, LLC, and Jarret Kolthoff, Founder and Former CEO of Speartip.

“ACG is the preeminent professional organization dedicated to mergers and acquisitions and its sector experts in St. Louis as well as across the country,” said Joe Mantovani, President of ACG St. Louis and Shareholder Attorney at Polsinelli. “The St. Louis chapter is thriving, and we are extremely proud of our newest members of the ACG St. Louis Advisory Board, who will continue to lead the organization to new heights. We also want to express our appreciation for our retiring board members, whose dedication and invaluable contributions have helped build our chapter into what it is today.”

As new members, Aaron Randolph and David Bentzinger will serve as directors on the board. As retiring directors, Thompson also served as the Sponsorship Chair and Northcott served as the Women’s Peer Group Chair.

With the new members, ACG St. Louis 2025 Chapter Advisory Board includes:

- President- Joe Mantovani, shareholder attorney, Polsinelli

- President Elect- Zach Waltz, managing director, head of corporate development, Harbour Group

- Past President- Holly Huels, founder and managing partner, Holleway Capital Partners

- ACG Global Board Liaison-Kevin Prunty, senior managing director, LongWater Capital Solutions

- Treasurer-Peter Berns, partner, RSM

- Secretary & Emerging Leaders Chair-Kelsey McGonigle, m&a and corporate partner, UB Greensfelder

- Membership Chair-Mandy Fritz, senior vice president, First Bank

- Sponsorship Chair- Tripp Kahle, senior vice president, U.S. Bank

- Programs Chair-Jeff Sackman, partner, RubinBrown, and managing director, RubinBrown Corporate Finance

- DealSource Chair- Heather Lewis, vice president of business development, WILsquare Capital LLC

- DEI Chair-Rene Morency, attorney, Prudent Counsel LLP

- Women’s Peer Group Chair- Robyn Frankel, principal, Frankel Marketing/PR

- Golf Tournament Chair- Nick Chambers, partner and midwest leader private equity services, UHY LLC

- Corporate Peer Group Chair- Jeff Giles, executive vice president corporate development, Core & Main LP

- Director-Bill Broun, president & CEO, Field & Stream Pet Food

- Director- Ray Wagner, managing director, Thompson Street Capital Partners

- Director-Aaron Randolph, senior vice president and commercial team lead, UMB Bank

- Director-David Bentzinger, managing director, PNC Bank

The ACG St Louis chapter, established in 1985, serves 400 members, including private equity investors, intermediaries, corporate development professionals, lenders, M&A advisors and service providers. Programs include networking events, corporate executive roundtables and high-level educational seminars. More information is available by contacting Amy Ruebsam, ACG St. Louis Executive Director, at aruebsam@acg.org or at www.acg.org/stlouis.

November 2024:

R.L. Hulett ("RLH") is pleased to announce that its client, Copp of St. Louis, Inc. ("Copp"), has been acquired by Warehouse Services, Inc. ("WSI"). In this transaction, RLH acted as exclusive financial advisor to the Seller.

Travis Greene, Owner and CEO, was seeking liquidity and a buyer with new capabilities, a larger service footprint, and enhanced sales and marketing resources to further Copp's growth.

"We are excited to partner with the WSI team and look forward to the next chapter of growth for Copp's employees and customers. We are grateful to all those employees who have played a vital role in getting the company where it is today and look forward to exciting things ahead. Thank you to the R.L Hulett team for their guidance in this complex process. We could not have done this without their expertise." - Travis Greene, Owner and CEO

ACG St. Louis announces 2024 Chapter Advisory Board

February 1, 2024, St. Louis – The St. Louis chapter of the Association for Corporate Growth (ACG), a global membership association for professionals involved in corporate growth, corporate development and mergers and acquisitions, announced two new appointments to its Chapter Advisory Board and recognized three retiring board members for their outstanding service and leadership.

The new directors include Jarrett Kolthoff, president of Speartip, and Heather Lewis, vice president of business development at WILsquare. Retiring directors include Patrick Nolan, president of Nolan & Associates; Mike Andrews, managing director at Husch Blackwell; and Bethany Michel, managing director at Harbour Group.

“ACG continues to stand as the preeminent professional organization dedicated to mergers and acquisitions and its sector experts,” said Joseph Mantovani, president, ACG St. Louis and shareholder, Polsinelli. “The St. Louis chapter is thriving, and we are extremely proud of our newest board members who will continue to use their expertise to lead the organization to new heights. We also want to express our appreciation for our retiring board members, whose dedication and invaluable contributions have helped build our chapter into what it is today.”

As new members, Jarrett Kolthoff and Heather Lewis will serve as directors on the board. As retiring directors, Nolan served in an advisory role following his term as president from 2019-2021. Mike Andrews was past chair of the Sponsorship Committee and Bethany Michel was past chair of the Wine Tasting and served on the STL Emerging 20 Committee.

With the new members, ACG St. Louis 2024 Chapter Advisory Board includes:

- President Elect- Joe Mantovani, shareholder, Polsinelli

- Past President-Holly Huels, managing partner, Holleway Capital Partners

- ACG Global Board Liaison-Kevin Prunty, senior managing director, LongWater Capital Solutions

- Secretary-Kelsey McGonigle, attorney, UB Greensfelder

- Treasurer-Peter Berns, partner, RSM

- Membership Chair-Mandy Fritz, vice president, PNC

- Sponsorship Chair- Rose Thompson, chief operating officer, ButcherJoseph & Co.

- Emerging Leaders Chair- Tripp Kahle, senior vice president, U.S. Bank

- Programs Chair-Jeff Sackman, partner, RubinBrown, and managing director, RubinBrown Corporate Finance

- DealSource Chair-Ray Wagner, managing director, Thompson Street Capital Partners

- Corporate Peer Group Chair-Jeff Giles, vice president corporate development, Core & Main

- Communications Chair-Robyn Frankel, principle, Frankel Marketing/PR

- DEI Chair-Rene Morency, attorney

- Women’s Peer Group Chair-Peggy Northcott, managing member, Capital Performance, LLC

- Golf Tournament Chair- Nick Chambers, director of private equity services, UHY LLC

- Director-Bill Broun, vice president m&a and corporate venture, Nestle Purina North America

- Director-Heather Lewis, vice president of business development, WILsquare

- Director-Jarrett Kolthoff, head of cyber, Zurich Resilience Solutions

The ACG St Louis chapter, established in 1985, currently has more than 400 members, including private equity investors, intermediaries, corporate development professionals, lenders, M&A advisors and service providers. Programs include in-person and virtual networking events, corporate executive roundtables and high-level educational seminars. More information is available by contacting Amy Ruebsam, ACG St. Louis Executive Director, aruebsam@acg.org or at www.acg.org/stlouis.

OCTOBER 2023

Holleway Capital Partners Acquires Barco Products

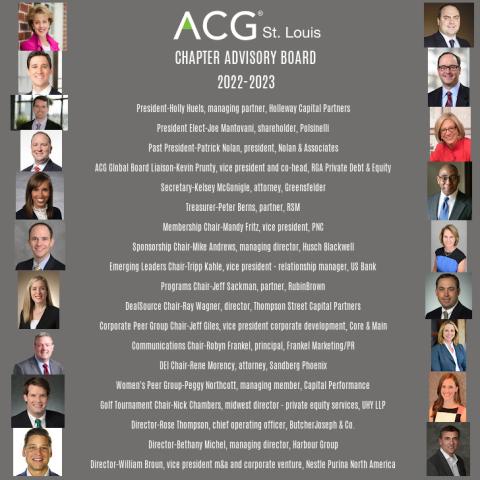

SEPTEMBER 2022 Tri Tech Automation Acquires Integrity Control Solutions Tri Tech Automation, a turnkey industrial automation systems integrator serving customers nationwide, has announced its acquisition of Integrity Control Solutions (ICS), a premium panel fabrication and installation company. Effective September 12, 2022, ICS will operate as Tri Tech Automation and Mike Summers, currently president of ICS, will become director of operations for Tri Tech Automation in Tulsa. “ICS is well-respected among customers and suppliers, and we are excited to have them become part of Tri Tech,” said Adam Ruebsam, president of Tri Tech Automation. “The acquisition is part of our company’s long-term strategic plan to expand services in design control solutions for manufacturers across US.” ACG St. Louis Announces 2022-2023 Chapter Advisory Board Image

September 1, 2022, St. Louis – The St. Louis chapter of the Association for Corporate Growth (ACG), an international membership association for professionals involved in corporate growth, corporate development and mergers and acquisitions, announced three new appointments to its Chapter Advisory Board and recognized two retiring board members for their outstanding service and leadership. The new directors include William Broun, vice president, mergers and acquisitions and corporate ventures, Nestle Purina North America; Rene Morency, attorney, Sandberg Phoenix; and Adrian “Tripp” Kahle III, vice president-relationship manager, U.S. Bank. Retiring directors include Gregory Coonrod, vice president and corporate controller, Barry Wehmiller, Companies, Inc. and Tom Horlacher, managing principal, Wolverine Business Advisors, LLC. “ACG is one of the fastest growing professional organizations and we are pleased to welcome our new board members, all of whom are leaders in mergers and acquisitions in their respective fields,” said Holly Huels, president of the ACG St. Louis chapter and managing partner, Holleway Capital Partners. “We also want to express our heartfelt appreciation to our retiring board members who have contributed greatly to making the St. Louis chapter a premier membership organization.” As new members, William Broun will serve as a director on the board; Rene Morency, will chair the DEI Committee; and Tripp Kahle, will chair the ACG St. Louis Emerging Leaders and Emerging 20 Committees. As retiring directors, Coonrod was board secretary and Horlacher was past chair of the Strategic Relations Committee. The ACG St Louis chapter, established in 1985, currently has more than 375 members, including private equity investors, intermediaries, corporate development professionals, lenders, M&A advisors and service providers. Programs include in-person and virtual networking events, corporate executive roundtables and high-level educational seminars. More information is available by contacting Amy Ruebsam, ACG St. Louis Executive Director, aruebsam@acg.org or at www.acg.org/stlouis.

With the new members, ACG St. Louis 2022-2023 Board of Directors includes:

Founded in 1954, ACG is the premier M&A deal-making community with a mission of driving middle-market growth. ACG’s global network operates within 61 local markets worldwide and comprises more than 100,000 middle-market professionals who invest, own and advise growing companies. Learn more about ACG and becoming a member at www.acg.org. JUNE 2022Compass Group Equity Partners announced the closing of Compass Group Fund II at its hard cap of $255 million, exceeding its original target of $200 million. In addition, Compass completed its first Fund II investment with the recent acquisition of KGM, a Tulsa-based, value-added distributor of valves, meters and regulators serving utilities and municipalities. The fundraising process took just over six months to complete and included commitments from a broad array of high-quality limited partners, including university endowments, family offices, pension funds, insurance companies, funds of funds and other institutional and high-net-worth investors. “The outcome surpassed our projections for both timing and value, and we’re honored by the level of investor confidence,” said John Huhn, Managing Partner of Compass Group, which focuses on helping lower middle-market companies grow and succeed. JANUARY 2022

BERKS Group Announces Investment in Trualta Kansas City, MO – December 2021 – BERKS Group announces its investment in Trualta, an e-learning platform focused on helping families manage the care of loved ones at home with clinically validated education. OCTOBER 2021Compass Group Equity Partners, a St. Louis-based private equity firm specializing in acquiring and building lower-middle market companies, expects its 2021 portfolio company investments to surpass $1.1 billion in annual revenue, a nearly 80 percent increase over 2020. Supporting that growth are more than 6,000 employees. With backgrounds in corporate development, operations and strategy, leveraged finance and investment banking, Compass Group’s investment team is targeted and thematic, identifying opportunities in niche markets with strong macro trends. Together with strong management teams, Compass drives intrinsic value through strategic planning and operational improvements to accelerate growth both organically and through additional acquisitions. SEPTEMBER 2021Thompson Street Capital Partners (TSCP), a private equity firm based in St. Louis, announced it has acquired Vector Laboratories, the Protein Detection business unit of Maravai (NASDAQ: MRVI). Vector Laboratories is a long-established, well-respected and innovative manufacturer of labeling and visual detection reagents for life science researchers doing tissue-based protein detection and characterization. The company’s primary end markets are academic research labs and corporations, provided either directly to customers or via distributors and resellers. The acquisition reinforces the long-term potential for Vector’s continued evolution and adds strength to TSCP’s experience in life sciences.

ACG St. Louis announces 2021-2022 Board of Directors August 31, 2021, St. Louis – The St. Louis chapter of the Association for Corporate Growth (ACG), an international membership association for professionals involved in corporate growth, corporate development and mergers and acquisitions, announced three new appointments to its board of directors and recognized four retiring board members for their outstanding service and leadership. The new directors include Jeff Giles, vice president corporate development, Core & Main; Bethany Michel, managing director, Harbour Group; and Jeff Sackman, partner, RubinBrown. Retiring directors include Lee Tilghman, vice president and senior relationship manager, Commerce Bank; Christy Oldani, marketing and business development lead, BKD; Ted Sengpiel, account executive life sciences, Jaggaer; and Heath Hunter, vice president corporate development, Dot Family Holdings. “We are pleased to welcome our new board members, all of whom have demonstrated a strong commitment to the organization through their past involvement, while extending our deep appreciation to former board members who have contributed greatly to making the St. Louis chapter a premier membership organization,” said Holly Huels, president of the ACG St. Louis chapter and managing partner, Holleway Capital Partners. As new members, Jeff Giles will chair the ACG St. Louis Corporate Peer Group; Bethany Michel, who will serve as a director on the board, previously served on the ACG St. Louis Emerging 20 committee; and Jeff Sackman, who will chair the ACG St. Louis Programs Committee, previously served on the ACG St. Louis Emerging Leaders and Emerging 20 committees. As retiring directors, all of whom served eight years, Tilghman was past chair of the Elite Speaker Series and a member of the Emerging Leaders and Membership committees, Oldani was past chair of the Membership committee and a member of the Emerging Leaders committee and Corporate Growth Conference, and Sengpiel was past chair of the Programs committee. In addition, Hunter was past chair of both the Corporate Peer Group and Family Office Peer Group. The ACG St Louis chapter, established in 1985, currently has more than 350 members, including private equity investors, intermediaries, corporate development professionals, lenders, M&A advisors and service providers. Programs include in-person and virtual networking events, corporate executive roundtables and high-level educational seminars. More information is available by contacting Amy Ruebsam, ACG St. Louis Executive Director, aruebsam@acg.org or at www.acg.org/stlouis. With the new members, ACG St. Louis 2021-2022 Board of Directors includes:

Founded in 1954, ACG is the premier M&A deal-making organization with 59 chapters worldwide. ACG’s global network comprises more than 100,000 middle-market professionals who invest, own and advise growing companies. ACG’s mission is focused on driving middle-market growth by bringing professionals together and giving them the resources to successfully navigate the industry landscape. More information is available at www.acg.org. Image

AUGUST 2021R.L. Hulett Releases Semi-Annual Report on Private Equity M&A Deal Activity in the State of Missouri JULY 2021Krishna Walker of CareVet Receives 2021 Corporate Counsel Award

Core & Main to Acquire Pacific Pipe Company, Inc. JUNE 2021Mueller Prost Joins Wipfli APRIL 2021Benjamin F. Edwards served as exclusive sell-side advisor to Himalayan Corporation in its sale to Prairie Dog. Himalayan, which is primarily engaged in the sale of premium cheese dog chews, actually invented the cheese chew category and remains the world leader in the supply of cheese chews. The Himalayan brand is synonymous with healthy, premium branded, all-natural dog chews. Prairie Dog Pet Products is a leading specialty manufacturer and marketer of premium, American-made dog treats, including freeze-dried treats, jerky, and natural parts. It focuses on providing fine quality ingredients formulated for dogs. Prairie Dog Pet Products is a portfolio company of Kinderhook Industries.

WILsquare Capital, a St. Louis-based private equity firm, announced that its portfolio company Crown Products Inc. has completed the acquisition of Tri-State Wholesale Flooring, a distributor of flooring products based in Sioux Falls, South Dakota. Terms of the transaction were not disclosed. Tri-State is the fourth company to become part of the Crown Products portfolio, beginning with the acquisition of Walcro of Bloomington, Minnesota in 2017, followed by Cartwright Distributing Inc. of Denver in 2019 and Jer-And Inc. in St. Louis in 2020. Based in Creve Coeur, WILsquare acquires and grows lower-middle market businesses in the Midwest and South, with an emphasis on business services, niche manufacturing, distribution and technology companies. MARCH 2021Thompson Street Capital Partners Acquires Freddy’s Frozen Custard and Steakburgers Thompson Street Capital Partners (TSCP) is proud to announce the acquisition of Freddy’s Frozen Custard & Steakburgers. A founder-owned Kansas-based franchisor of fast casual restaurants, Freddy’s is known for its steakburgers, shoestring fries and freshly churned frozen custard. Freddy’s opened its first franchise location in 2004 and has grown to more than 360 franchised locations and over 30 company-operated restaurants throughout the U.S. The acquisition reflects TSCP’s thesis-driven approach to investing. TSCP continues to seek out interesting franchise businesses across a variety of end-markets. For more information contact Kevin Kerr, kkerr@tscp.com or 314-446-33390.

BERKS Group Announces Sale of International Sports Science Association (ISSA) to Tailwind Capital The BERKS Group (BERKS) announced its sale of International Sports Science Association (ISSA) to Tailwind Capital (Tailwind). Harris Williams served as advisor on the transaction. ISSA, a premier eLearning platform to the global fitness and wellness industry, has trained more than 300,000 students in more than 140 countries. The BERKS Group, (www.berksgroup.com) owned by the Bradley family, is a diversified family of companies with holdings in education technology, high-value precision manufacturing, technology infrastructure, and better for you consumer brands. The BERKS manufacturing platform is concentrated in aerospace, defense and medical instruments. For more information, contact John Kueneke, jkueneke@npgco.com FEBRUARY 2021Core & Main LP, a leading U.S. distributor of water infrastructure products and services, has plans to grow its presence in West Texas. The company has signed an agreement to acquire Triple T Pipe & Supply, LLC, based in Lubbock, Texas. Financial terms were not disclosed. The deal will expand Core & Main’s customer base and geographic reach for its waterworks business. Founded in 2014, Triple T Pipe & Supply is one of Lubbock’s top waterworks distributors, providing outstanding customer service for West Texas and New Mexico. Triple T provides pipe, valves, hydrants and fittings to contractors for any size job. Core & Main currently serves West Texas from its locations in El Paso and San Angelo, Texas. Upon closing, this acquisition will mark the 12th since Core & Main became an independent company in 2017. JANUARY 2021Holleway Capital Partners Acquires Family-Owned Texdoor LLC

Nolan Advised Ferguson Consulting on Its Sale to Eliassen Group DECEMBER 2020Rick Hennessey Chosen as Winner of the 11th Annual Emerging Leaders Award ButcherJoseph & Co. (“ButcherJoseph”) is proud to announce that Rick Hennessey, Vice President, was selected as a winner of The M&A Advisor Emerging Leaders Award. Hennessey was chosen for his accomplishments and expertise in the industry from a pool of international nominees by an independent judging panel of distinguished business leaders. Hennessey joined the firm in 2015 as an Analyst. He quickly rose through the ranks to become a Vice President where he has made a significant impact mentoring junior professionals in the firm and building relationships with clients to help them navigate an optimal transaction experience. Most recently, Hennessey was a graduate of the inaugural ACG St. Louis Emerging 20 class of 2019-2020 — an elite group of future business leaders in the St. Louis middle market M&A community. ButcherJoseph personnel have received this prestigious recognition since 2014, marking 2020 as the firm’s seventh consecutive year of growing and developing the M&A industry’s most talented professionals.

BERKS Group Announces Investment in Natomas Manufacturing LLC The Berks Group (berksgroup.com), Kansas City, announces an investment in Natoma Manufacturing, Norton, KS, with customers primarily in the aerospace and defense markets. Natoma manufactures build-to-order precision parts for its global customers. The company holds ISO 9901 and AS9100 certifications. The addition of Natoma expands BERKS’ precision manufacturing platform to three companies focused on the aerospace, defense, medical and industrial sectors. BERKS also owns Swiss-Tech, LLC and IDC LLC, both in Wisconsin. Swiss-Tech manufactures precision parts for medical, aerospace and industrial end markets. IDC manufactures high quality, complex components primarily used in aerospace and defense. Contact: Jay Longbottom, (816-271-8519) or John Kueneke, (314-504-5072) OCTOBER 2020BERKS Group Announces Investment in Instrument Development Corporation (IDC) BERKS Group announces an investment in Instrument Development Corporation (IDC). Founded in 1987, IDC is an ultra-precision machining company based in Mukwonago, Wisconsin. The company delivers high quality, complex components primarily used in defense and aerospace systems. BERKS is planning capital investments to expend IDC’s capabilities and increase production. The addition of IDC expands BERKS precision manufacturing platform with increased capabilities and new market segments. BERKS also owns Swiss-Tech, LLC, which manufactures mission critical precision parts for medical, aerospace and industrial end markets. Swiss-Tech is based in nearby Delavan, Wisconsin. More information is available at www.berksgroup.com.

Holleway Capital Partners Expands Investment Team Image

Holleway Capital Partners is pleased to announce the addition of Abigail Graham as an Analyst. She supports the team with a variety of responsibilities, including industry research, financial modeling, and due diligence efforts. Prior to joining Holleway Capital, Abby served as Senior Consultant with Ernst and Young’s Risk Advisory Services practice. In this role, Abby managed teams providing Sarbanes-Oxley compliance testing and assurance to national and international clients. Abby graduated from the University of Missouri with a Bachelor of Science in Mathematics and minors in Business Finance and Statistics. Holly Huels, Managing Partner at Holleway Capital said, “We are delighted to have Abby as part of our team. She brings to the team an enviable combination of technical knowledge with a self-starter, can-do and team-first attitude. We look forward to her contributions to Holleway and our portfolio companies." Image

SEPTEMBER 2020ACG St. Louis Announces 2020-2021 Board of Directors ACG St. Louis welcomes two new members to its board of directors: Kelsey McGonigle of Greensfelder and Nick Chambers of UHY LLP. McGonigle is a senior associate in Greensfelder’s Business Services Group, focusing primarily on mergers and acquisitions in the middle market space. She serves on the ACG St. Louis Emerging Leaders Committee and recently completed the STL Emerging 20 Leadership Program. Chambers is director of the Private Equity Services Group for UHY LLP in St. Louis. He provides accounting, audit and consulting services to private equity groups and their portfolio companies and specializes in complex financial reporting issues, such as business combinations, revenue recognition, leases, debt and equity transactions and income taxes. ACG St. Louis recognizes the following retiring board members for their outstanding service and leadership: John Huhn of Compass Group Equity Partners, Steve Wendling of UHY LLP and Patrick Sweeney of Greensfelder. Huhn served eight years on the board and spearheaded the creation of the Family Office Peer Group; Wendling served eight years on the board and chaired the annual ACG Golf Tournament, and Sweeney served five years on the board and serves on the Membership Committee. ACG St. Louis 2020-2021 Board of Directors:

The ACG St Louis chapter serves more than 350 members involved in corporate growth and include private equity investors, intermediaries, corporate development professionals, lenders, M&A advisors and service providers – all working together to get the deal done. AUGUST 2020Alliance Systems Becomes a Red Hat Partner Alliance Systems, LLC a leading provider of cloud-native application development services has become a Red Hat Partner. Red Hat is recognized as the world's enterprise open source leader. Alliance Systems’ cloud-based solutions, now with Red Hat, offer improved scalability, stability, and performance which are key benefits for businesses including enterprise and governmental clients. Red Hat’s enormously deep suite of products such as OpenShift and Ansible aligns well with Alliance’s commitment to bringing the most value and performance to their clients, whether they be enterprise, mid-market or startup. Located in St. Louis, Alliance Systems has clients in finance, e-commerce, education, manufacturing, and government. For additional information visit www.alliance-systems.co or call 314-219-7887.

JULY 2020

ButcherJoseph & Co. has promoted Rose Thompson to Chief Operating Officer and Rick Hennessey to Vice President. In her new role, Rose will oversee the performance, alignment and overall strategy for the investment bank, which specializes in M&A advisory services to provide highly customized solutions for middle market companies. Rick will continue to serve in a leadership role in the firm’s deal execution efforts advising middle market companies on mergers and acquisitions, recapitalizations, corporate carve outs, capital raising, and leveraged ESOP buyout transactions. He earned his Bachelor of Business Administration, magna cum laude, from the Mendoza College of Business at the University of Notre Dame. In addition to serving on the Board of Directors for ACG St. Louis, Rose is actively involved with the National Center for Employee Ownership (NCEO) and the ESOP Association, where she participates at annual conferences, webinars, and seminars across the U.S. She earned both her Master of Arts and Bachelor of Arts degrees in communication from Saint Louis University. |

Nolan & Associates, an investment banking firm specializing in the middle market, announced that it recently advised Doximity on its acquisition of THMED. Doximity is the largest professional medical network for U.S. healthcare professionals, with more than 70% of U.S. doctors and 45% of all nurse practitioners and physician assistants as members. Doximity is venture-backed with Emergence Capital, InterWest, Morganthaler, Morgan Stanley and T.Rowe Price as investors. Doximity sought to enter the physician recruiting and locum tenens markets via acquisition. Nolan’s process delivered THMED, a leading healthcare staffing firm focused on permanent physician and locum tenens placements. THMED was a portfolio company of Waveland NCP Texas Ventures (WNCP), a partnership between New Capital Partners and Waveland Ventures. Nolan & Associates, an investment banking firm specializing in the middle market, announced that it recently advised Tacony Corporation on the successful sale of its subsidiary company, Nancy’s Notions, to Missouri Quilt Company. Nolan’s competitive sale process delivered Missouri Star Quilt Company as the ideal buyer for Nancy’s Notions, uniting the two most powerful brands in the sewing and quilting space. Interestingly, Due to COVID-19, the buyer and seller never held a face-to-face meeting during the sale process. The deal team utilized video conferencing for conversations, due diligence and inventory inspections. The U.S. craft industry is estimated at $36 billion, with sewing and fabric ranking in the top 5 crafts at 11.3% total spend. |

Anders CPAs + Advisors, one of the St. Louis region’s largest accounting firms, is expanding its reach in the banking industry with the acquisition of Cummings, Ristau & Associates, a south St. Louis County-based public accounting firm, effective June 30. With the addition of all 21 of Cummings Ristau’s employees, Anders’ staff will total 230 with revenue of about $41.5 million, officials said Monday. While Anders has served the broker/dealer and financial services industries since it was formed in 1965, acquiring Cummings Ristau allows Anders to add a new niche and expand its financial institution footprint. Cummings Ristau provides audit, tax, regulatory compliance and loan review services to banks and credit unions, among other services.

Image

Bob Alvarez has been elevated to President and COO of Shapiro Metals, a St. Louis-based nationwide provider of scrap metal recycling services and full-scale sustainability programs to manufacturers across the country. He is the first person outside the Shapiro family to hold the title of President at the privately-owned company which is currently celebrating its 50th anniversary. Bob joined the company in 2015 as Vice President of Operations with a diverse background, having held management roles in Operations and HR, in addition to his deep experience in strategic and organizational leadership. He earned his Bachelor of Arts degree from Knox College, Galesburg, Ill. |

Register by January 14 to maximize value, elevate your experience, and get a head start connecting with 3,200+ dealmakers and executives.