Session Details

In today’s competitive capital landscape, funding alone is no longer the differentiator, strong founder–investor alignment is. This panel examines what healthy, high-impact investor–founder relationships actually look like in practice and why the right partnership can be as critical as the capital itself.

Experienced founders and investors will unpack common misalignment patterns that often derail companies after investment, from mismatched expectations to ineffective governance and communication breakdowns. The discussion will also explore board dynamics, decision-making frameworks, and how the best investors support founders well beyond the check.

Founders will walk away with practical guidance on how to evaluate potential investors, ask the right questions, and choose partners who will truly help them navigate growth, complexity, and change.

Speaker Bios

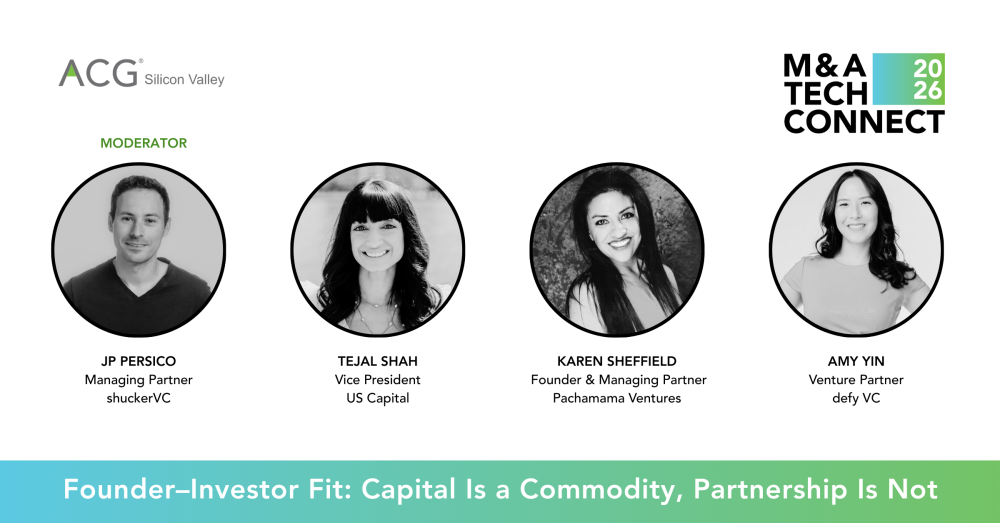

Tejal Shah, Vice President of Investment Banking at US Capital

I am seasoned founder-turned-financier who’s helped scale companies from zero to $400M+, raised millions in venture funding, and now structures complex deals that go beyond the usual playbook.

With over 10 years of experience in early-stage startups, I have successfully built and scaled multiple businesses from concept, business plan, funding, to market launch and beyond. I have a deep understanding of the startup ecosystem including business development, fundraising, and operations.

My background in financial services and asset management has provided me with a strong foundation to navigate the complexities of fundraising, budget and tax management with confidence. Furthermore, my degree in Mechanical Engineering highlights appreciation of emerging technologies.

Karen Sheffield, Founder & Managing Partner of Pachamama Ventures

Karen Sheffield is the Founder & Managing Partner of Pachamama Ventures, a venture capital firm investing in US early-stage climate tech companies. Previously, she worked for American Airlines, PepsiCo, and Visa in multiple and progressing finance roles. A self-described operator turned investor, Karen began angel investing 5 years ago and, ever since then, has dedicated much of her time to uncovering opportunities in unlikely places. Karen holds a double degree in Finance and Economics from Texas Christian University (TCU) and an MBA from The University of Texas at Austin.

Karen is an active member of several organizations such as Global Women in VC, WeInvest LATAM, Pipeline Angels (as a VC-in-Residence), among several others. She has also been featured in the Snowball Wealth podcast, StrtupBoost, Women in Climate, VC Lab, and others as a guest speaker. She has made several sector-agnostic pre-seed and seed investments to date (including 6 climate tech deals) and she sits in the advisory board of 2 startups and 1 non-profit organization.

Karen is the "2025 NAWRB Climate Leader" Award recipient with recognition from the California Treasurer's Office and Fiona Ma herself.

JP Persico, Co-Founder & Managing Partner at shuckerVC (moderator)

Jean-Philippe "JP" Persico has over 20 years of experience in business transformation, corporate growth development, and digitalization across various industries including SaaS, e-commerce, and automotive. He is currently a Co-Founder and Managing Partner at shuckerVC, a $10M Bay Area seed fund investing in AI-powered B2B software companies.

Before co-founding shuckerVC, JP served as the Head of Strategy and Corporate Venture Capital (CVC) for a major industrial conglomerate. There, he led investments, formed startups, and managed joint ventures. His investments have shown impressive growth, achieving a 25x MOIC (Multiple on Invested Capital) and attracting major VC firms to lead future rounds.

JP's operational experience includes a role as VP of Platform and Business Development at a mobile auto repair software platform. In this position, he contributed to a 20x growth in corporate business and optimized operating margins through platform migration. He also founded a Latin American e-commerce marketplace app.

In addition to his venture capital and corporate roles, JP advises SaaS, AI, and deep tech startups. He has been involved with organizations such as Swissnex and Techstars.

JP holds an MBA from Northwestern University's Kellogg School of Management.

At shuckerVC, JP leverages his extensive experience in corporate strategy, venture capital, and startup operations to create real value add for their portfolio.