Share:

Image

Event Details

When:

August 2, 2019 7:30 AM - 9:30 AM EDT

Where:

Location Name

St. Petersburg Yacht Club

Overview

Body

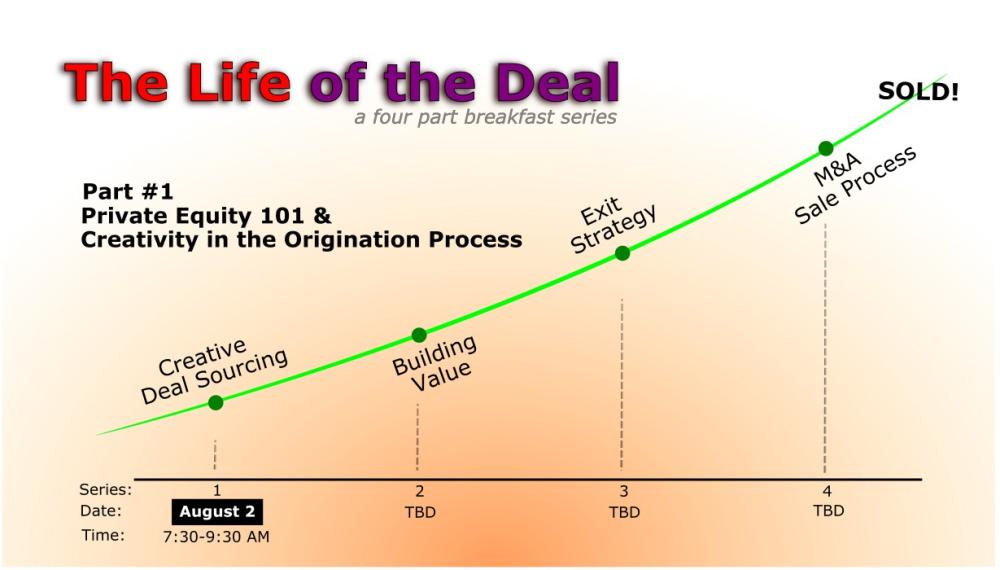

Part # 1 - “Private Equity 101 & Creativity in the Origination process”

“Private Equity 101” will help place a context for the rest of the series. We will discuss:

- What private equity truly is, its approximate size, the participants, and what drives successful outcomes

- How to exercise creativity in the origination process

- How to best build the relationships necessary to source deals, profile targets, evaluate opportunities in the context of macroeconomic and micro-economic trends, and to capitalize on marketing opportunities

- The role of management skills, operations, and human resources in the context of origination

- How to ensure that the right pre-diligence steps are taken before investment committee or owner review

Stay Tuned for Dates & Times

Part # 2 - “Value Enhancement Strategies”, This part will focus on value-enhancement initiatives

Part # 3 - “Exiting the Investment”, This part will discuss various alternatives for optimal exit strategies

Part # 4 - “The M&A Sale Process and Financing Options”, This part will discuss how the M&A sale process

Part # 3 - “Exiting the Investment”, This part will discuss various alternatives for optimal exit strategies

Part # 4 - “The M&A Sale Process and Financing Options”, This part will discuss how the M&A sale process

works, financing options, and the mechanics of acquisition leverage

Speakers

Hosted by: ACG

Chapter

Tampa Bay