Share:

Image

Event Details

When:

January 10, 2020 7:30 AM - 9:30 AM EST

Where:

Location Name

St. Petersburg Yacht Club

Overview

Body

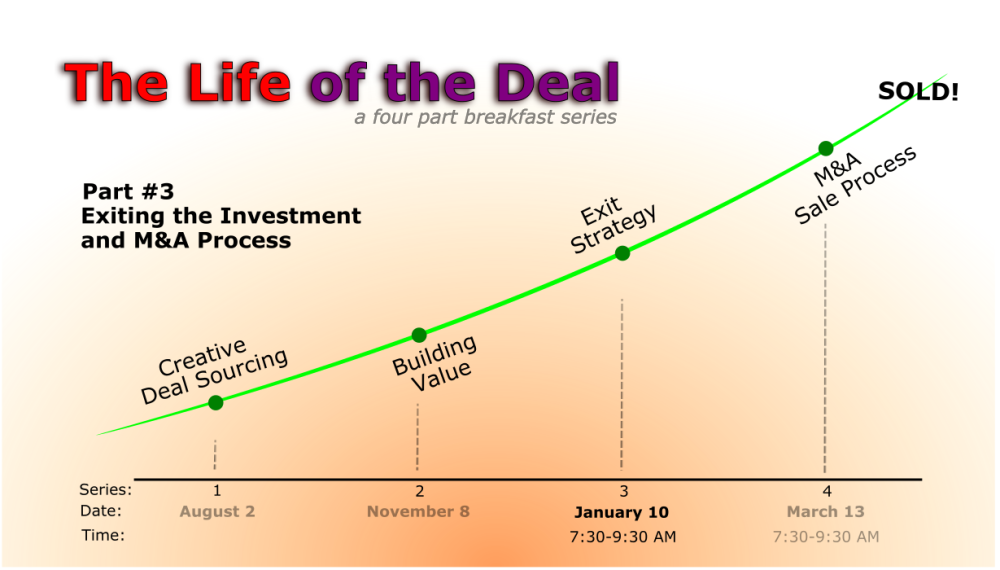

Join us for lively discussions on various alternatives for optimal exit strategies that includes IPOs, strategic acquirers and equity sponsors. Discussion will take into account the macro and micro economic trends, financial performance and structure of the company, and what are some of the impacts on each choices made.

Esteemed panelists will also demonstrate how to maximize the exit value while demonstrating to the acquirer their path to growth in their investment.

Speakers

Hosted by: ACG

Chapter

Tampa Bay