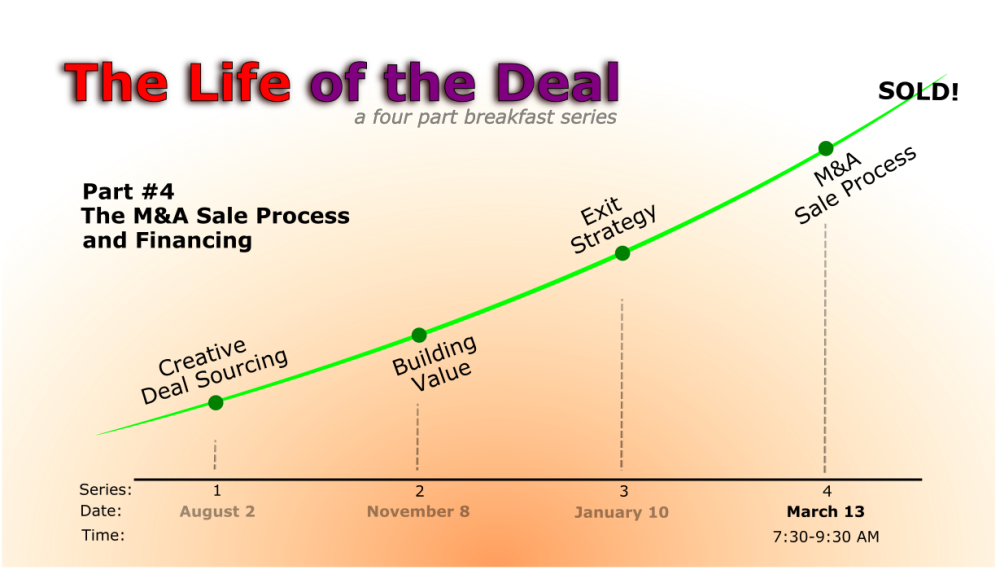

Event Details

When:

March 13, 2020 7:30 AM - 9:30 AM EDT

Where:

Overview

Unfortunately, COVID-19 has affected travel for some of our panelists, and therefore ACG Tampa Bay has decided to postpone/reschedule tomorrow’s breakfast meeting, “The Life of The Deal”.

We will be looking for a future date, and will let you know as soon as possible. We can use your registration fee toward the rescheduled date OR if you would like us to refund you NOW, please email Brooke Grizzard, at acgtampabay.admin@acg.org

Thank you for your understanding and stay healthy!

We will discuss how the M&A sale process works and financing options.

- How a company is sold, a detail description of the steps involved with the sale process and how best to manage this process from selecting a banker to preparing to go to market.

- Identifying different types of financing available, senior, uni-tranche and mezzanine and how each fit relative to the types of deals.

- Mechanic of acquisition leverage. What is the optimal leverage level, and how to strike the right balance between maximizing equity returns and supporting leverage in light of covenants and cash to service the debt.