Event Details

When:

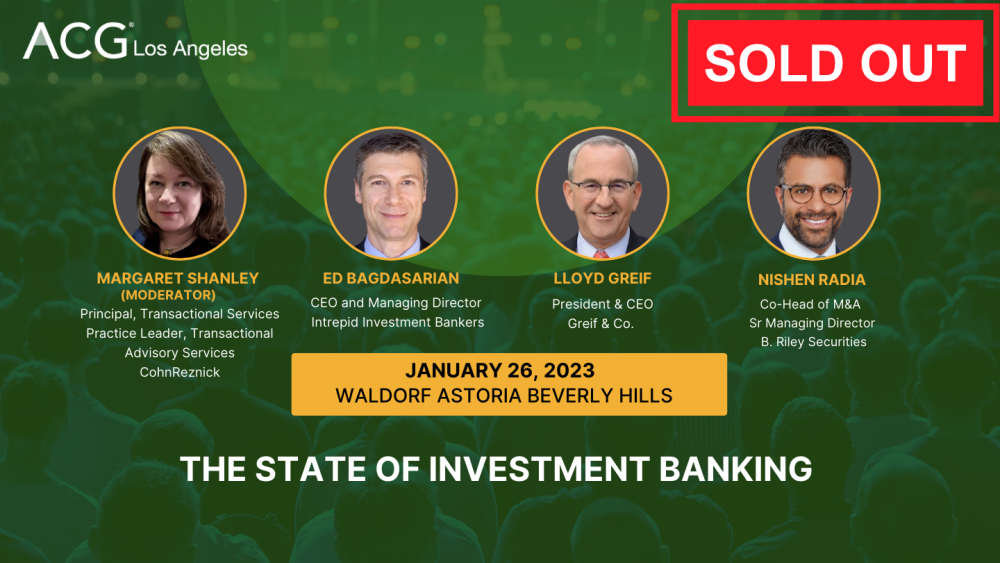

January 26, 2023 5 PM - 8 PM PST

Where:

Overview

Speakers

ONLINE REGISTRATION IS NOW CLOSED. THIS EVENT IS SOLD OUT!

We're kicking off 2023 with an incredible lineup of expert speakers to bring you, The State of Investment Banking. We'll look back at 2022 to discuss what worked, challenges and successes, and then look ahead at the outlook for 2023 for deal flow, trends, impact on the public market and so much more.

Join us on Thursday, January 26th at the Waldorf Astoria Beverly Hills for a discussion you will not want to miss!

ASTOR BALLROOM- 2ND FLOOR

Agenda:

5:00PM: Registration + Welcome Reception

6:00PM: Panel Presentation

7:00PM: Networking Cocktail Reception

Registration: Member: $95 | Non-member: $135

*Business Casual Attire. Valet Parking Included

Hosted by: ACG

Event Materials

THIS EVENT IS SOLD OUT!

Agenda: EVENT IS IN ASTOR BALLROOM- SECOND FLOOR

5:00PM: Registration + Welcome Reception

6:00PM: Panel Presentation

7:00PM: Networking Cocktail Reception

Member: $95 | Non-Member: $135

*Business Casual Attire. Valet Parking Included