Overview

REGISTRATION IS NOW CLOSED

ACG NY VVIP Luncheon | Cannabis Investment Opportunities

While there are portions of the Marijuana Regulation and Taxation Act (MRTA) that became legal right away, there are certain parts of the law that New Yorkers will have to wait for.

Our expert panel will discuss the social, economic, legal and business opportunities this extraordinary legislation will present to society and the M&A community. Are some opportunities, just like the law, still off limits? Will the federal prohibition of Cannabis soon end?

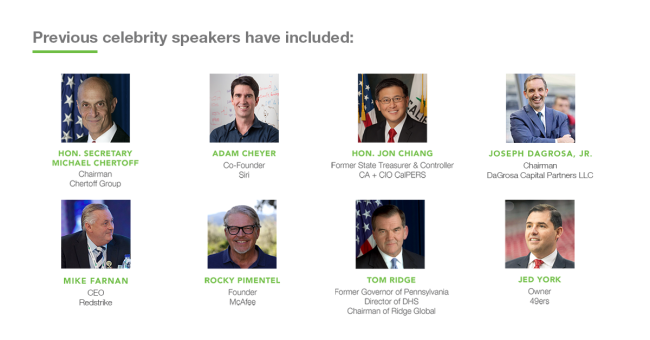

Speakers

ACG NY recruits best-in-class speakers for our virtual and in-person events.

CLICK TO REQUEST AN INVITATION

CHECK OUT THE FULL SERIES & DATES

| March 23, 2021 | May 4, 2021 | July 15, 2021 |

Hosted by: ACG

Sponsors

Event Materials

Complimentary for Members and Invited Guests

Please contact ACG New York for more information.

Future ACG NY VIP Luncheons: July 15, 2021 and August 17, 2021

All H2 Events, unless otherwise stated, are currently scheduled as virtual. As the year progresses and official guidelines allow, ACG NY will host the events either hybrid or in person. ACG NY always puts members health first and adheres to all federal and local public health standards. Please check our website for the most up to date information on all events and programs.