Overview

Biden's China Policy - The Balancing Act

not retreat from it'.

- Epicenters of conflict

- Chinese “Red Lines”

- US sanctions - multi-lateral adoption

- How can China strike back?

- Globalization to Regionalization - Chinese “Soft Power” and regional economic “Entanglements”

- The 14th Five Year Plan

- Limits of US military “hard power” in Asia

- The concept of decoupling

- Alternatives to public hard sanctions

- Impact on U.S commerce and markets

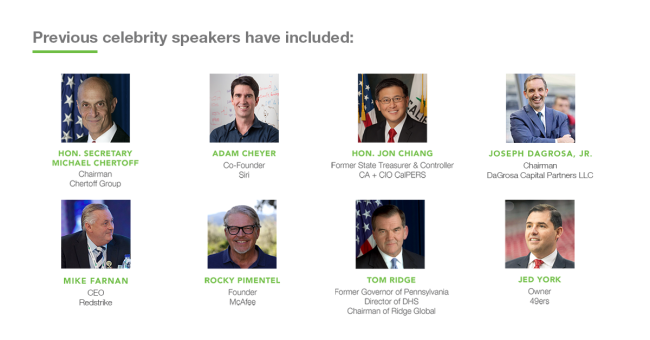

Speakers

ACG NY recruits best-in-class speakers for our virtual and in-person events.

CLICK TO REQUEST AN INVITATION

CHECK OUT THE FULL SERIES & DATES

| March 23, 2021 | May 4, 2021 | July 15, 2021 |

Hosted by: ACG

Sponsors

Event Materials

Complimentary for Members and Invited Guests

Please contact ACG New York for more information.

Future ACG NY VVIP Luncheons: May 4, 2021, July 15, 2021 and August 17, 2021

All H2 Events, unless otherwise stated, are currently scheduled as virtual. As the year progresses and official guidelines allow, ACG NY will host the events either hybrid or in person. ACG NY always puts members health first and adheres to all federal and local public health standards. Please check our website for the most up to date information on all events and programs.